Employees who spend money on behalf of your organisation are often reimbursed through payroll or as a separate payment. There are several ways to do this. Note that we are referring to Reimbursement, so it is assumed these Reimbursements aren’t taxable for the purposes of this help note which provides general, educational information only.

Two methods are covered in this help note. Please seek advice for other alternatives:

Paying Employee Reimbursable Expenses via Payroll

Employee Expense reimbursements which are not reportable via Single Touch Payroll (STP) require you to setup a Pay Item for use in your pays.

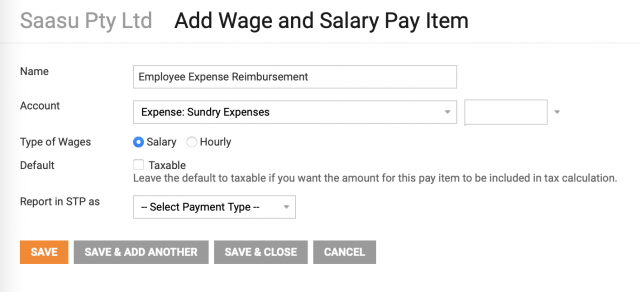

1. Setup an Reimbursable Expenses Pay Item:

- Go to Settings COG Icon > Settings (for this file) > Scroll down to Payroll and click on Manage Pay Items.

- Click on Wage and Salary option at the top of the list of Pay Items.

- Name the pay item something that make sense to you and your advisor such as Employee Expense Reimbursement.

- Set the Account to be be how you want to account for the Expense

- Leave the W-code (Wage and salary tax codes) picklist option to the right of the Account field blank (unselected).

- Leave the type as Salary selelected (even though it isn’t Salary or a Hourly wage). It just means it is not based on Hours calculation for this situation.

- Untick taxable as this scenario covers where these expenses are not taxable wages or salary and are not FBT related.

- Leave the Report in STP picklist as –Select Payment Type– and save the Pay Item.

- You will see a warning message “You have not selected a payment type. The amount for this pay item will not be included in STP reporting. Continue?“

- Click OK to accept.

2. Adjust your SGC Super Pay Item and other Leave Pay Items to exclude these payments from the calculation:

- Go to Settings COG Icon > Settings (for this file) > Scroll down to Payroll section and click on Manage Pay Items.

- Look for your Employer Contribution > Superannuation Guranatee Contribution (SGC) pay item and click to open it with the pencil edit icon to the right.

- Click on Exclusions and then tick the Pay Item you just created and then click the OK button.

- Repeat the above for other Pay Items such as Entitlements like Personal Leave.

This will make sure you aren’t calculating Super or Leave on these payments.

3. Claim GST if applicable.

Check with your accountant as you may be able to claim GST on purchases your employee has made on your businesses behalf. You may need to do a journal to capture the GST.

Paying Employee Reimbursable Expenses via a Purchase

Bulk-enter Expenses in a Single Purchase Transaction

Enter a purchase using the Employee as the Contact with each line item in the Purchase representing the individual expense items (use the description field to add detail regarding who the Contact is for, the expenses, the date of the expense, etc). When you make the Reimbursement Payment to the employee you can apply this to the Purchase accordingly. Attach receipts and claim forms to the Purchase transaction as scanned documents. The negative side to this approach is that you lose supplier Contact tracking because the Contact on the Purchase is the person you are reimbursing. This method isn’t great when you want to track other information about the expense. For example, an asset purchase or other expenses that have more complex tax, asset and/or inventory implications.

Capture each Expense Individually as a Purchase

Enter each expense as a separate Purchase that you want to track against suppliers. When it is time to reimburse the person using an online banking transfer payment, check, or alternative method, you apply a payment to all those outstanding purchases at once. As an example, you may apply $1000 to a dozen different purchases. This creates just one payment on the Bank Reconciliation, which makes it easy.