Not a customer? Use Saasu FREE for 30 Days

For detailed information on how Employers should enrol and manage JobKeeper payments please refer to the ATO guidance at JobKeeper Payment > Employers.

Further information may come to hand from the ATO as they complete their process for managing this initiative. We will post updates on this page.

Notify the ATO of eligible employees

- The ATO has introduced different options for employers to identify the eligibility of employees to receive the JobKeeper payment.

- If your preferred option is to use STP reporting in Saasu, you will need to identify them as eligible by setting up and reporting an Allowance Pay Item;

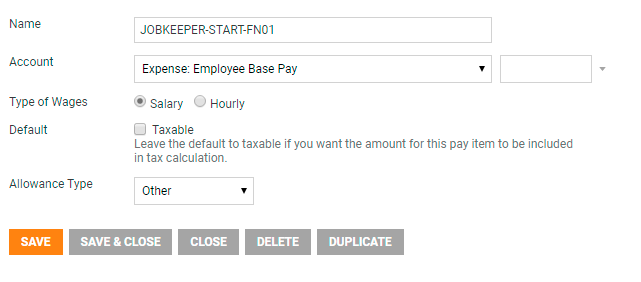

- Click on View > Payroll > Setup Pay Items

- Click Add: Wage and Salary

- Type – “Other”

- Name – “JOBKEEPER-START-FNxx”, where “xx” refers to the fortnightly period from which the payment first started e.g. JOBKEEPER-START-FN01 refers to the 1st fortnight period of JopbKeeper payments

- This allowance pay item only needs to be used once per employee to indicate when the JobKeeper payments started. You do not post the JOBKEEPER-START-FNXX pay item every pay.

- Use the following table to determine the allowance pay item to set up and use depending on when the employee became eligible/ineligible for the JobKeeper payment.

- It is important the pay item name is in the exact format as below for the corresponding fortnight, and the type is set to “Other”. This is the format expected by the ATO.

| Fortnight | Dates | Allowance Name(payment start) | Allowance Name(payment end) |

| 01 | 30/03/2020-12/04/2020 | JOBKEEPER-START-FN01 | JOBKEEPER-FINISH-FN01 |

| 02 | 13/04/2020-26/04/2020 | JOBKEEPER-START-FN02 | JOBKEEPER-FINISH-FN02 |

| 03 | 27/04/2020-10/05/2020 | JOBKEEPER-START-FN03 | JOBKEEPER-FINISH-FN03 |

| 04 | 11/05/2020-24/05/2020 | JOBKEEPER-START-FN04 | JOBKEEPER-FINISH-FN04 |

| 05 | 25/05/2020-07/06/2020 | JOBKEEPER-START-FN05 | JOBKEEPER-FINISH-FN05 |

| 06 | 08/06/2020-21/06/2020 | JOBKEEPER-START-FN06 | JOBKEEPER-FINISH-FN06 |

| 07 | 22/06/2020-05/07/2020 | JOBKEEPER-START-FN07 | JOBKEEPER-FINISH-FN07 |

| 08 | 06/07/2020-19/07/2020 | JOBKEEPER-START-FN08 | JOBKEEPER-FINISH-FN08 |

| 09 | 20/07/2020-02/08/2020 | JOBKEEPER-START-FN09 | JOBKEEPER-FINISH-FN09 |

| 10 | 03/08/2020-16/08/2020 | JOBKEEPER-START-FN10 | JOBKEEPER-FINISH-FN10 |

| 11 | 17/08/2020-30/08/2020 | JOBKEEPER-START-FN11 | JOBKEEPER-FINISH-FN11 |

| 12 | 31/08/2020-13/09/2020 | JOBKEEPER-START-FN12 | JOBKEEPER-FINISH-FN12 |

| 13 | 14/09/2020-27/09/2020 | JOBKEEPER-START-FN13 | JOBKEEPER-FINISH-FN13 |

- Example: an employee is paid $3000 fortnightly via a pay run and becomes eligible for JobKeeper payment on the 14th April. Pay date is 22nd April;

- Create the JOBKEEPER-START-FN02 allowance pay item if not already created.

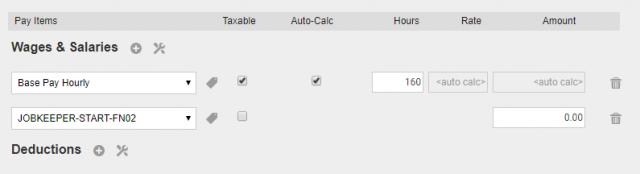

- Go to View > Employees. Find the employee in the list and click on the Next Pay icon. Under Wages and Salaries, select JOBKEEPER-START-FN02 pay item.

- Click Save and Close.

- When the pay run is approved and the pay entry is created for the employee, the JOBKEEPER-START-FN02 will be included in the pay. When the employer submits the STP pay event consisting this pay to the ATO this allowance pay item will be reported to notify the JobKeeper payment for the employee started from the 2nd fortnight.

- Note for manual pay i.e. employee is not paid through a pay run, add the allowance pay item when creating the payroll entry and enter 0.01 cents as the amount as unfortunately the manual payroll entries will not allow a $0.00 amount.

- When an employee becomes ineligible for the JobKeeper payment, the allowance pay item JOBKEEPER-FINISH-FNxx should be used to notify the ATO when the eligibility ceased. For example, if the employee becomes ineligible on 04 Jun, use the allowance pay item JOBKEEPER-FINISH-FN06 (the fortnight from which the subsidy will no longer apply).

JobKeeper payment top up amounts

- For all payroll cycles, the employer is required to pay a minimum of $1,500 for each fixed JobKeeper fortnightly period.

- If you have employees earning less than $1500 a fortnight, you need to top up their salary to meet the minimum payment amount requirement to remain eligible.

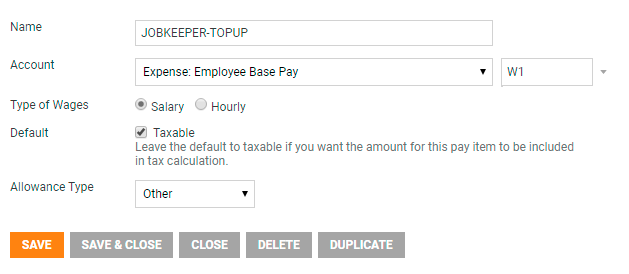

- In order to notify the ATO of the top up amount, create an Allowance pay item of type Other with the name “JOBKEEPER-TOPUP”, and use this pay item to record the top up amount in employee’s pay.

- It is important the pay item is named exactly as JOBKEEPER-TOPUP and the type is set as “Other”. This is the format expected by the ATO.

- Open the Employer Contribution pay item for SGC and select “Exclusions” link and tick this pay item to exclude it from SGC calculations.

- This allowance pay item needs to be included in all future pays with the top up amount to ensure the employee meets the eligibility criteria.

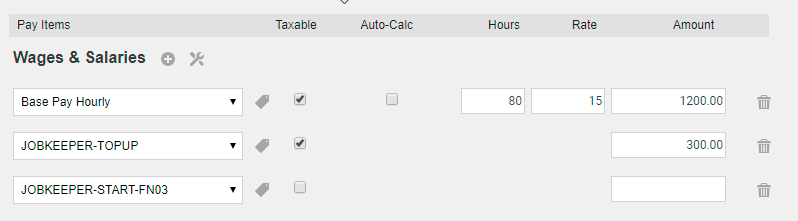

- Example: an employee is getting paid $1200 a fortnight via pay run and becomes eligible for JobKeeper payment on the 28th April and the next pay is due on the 7th May.

- Create the JOBKEEPER-START-FN03 allowance pay item if not already created.

- Create the JOBKEEPER-TOPUP allowance pay item if not already created.

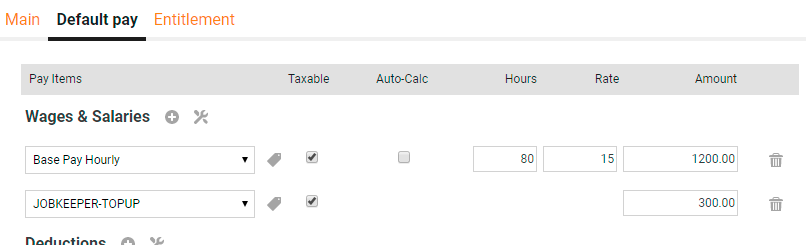

- Go to View > Employees and click on the edit icon for the employee in the list.

- Switch to the Default Pay tab and select JOBKEEPER-TOPUP pay item under Wages and Salaries, and enter $300 which is the top up amount to increase the employee’s regular pay to the minimum required amount of $1500.

- Click on Save and Close.

- Click on the Next Pay icon adjacent to the employee in the list.

- Under wages and Salaries, select JOBKEEPER-START-FN03 pay item.

- Click on Save and Close.

- When the pay run is approved and the payroll entry is created for 7th May for the employee;

- JOBKEEPER-START-FN03 pay item will be included in the pay.

- JOBKEEPER-TOPUP pay item will be included in the pay for the top up amount.

- When this pay is reported via STP the ATO gets notified the JobKeeper payment for the employee started from the 3rd fortnight, and a top up amount of $300 was paid to meet the eligibility criteria.

JobKeeper payment corrections

- If pays were already completed without the JOBKEEPER-START code, either create an out of cycle pay (Add > Payroll), or add this into the next regular cycle. Please do not delete your existing pay runs and try to replace these through Single Touch Payroll

- Any JobKeeper top up payment amounts that were recorded without using the JOBKEEPER-TOPUP pay item in the month of April can be fixed by using the correct pay item in the next regular pay cycle or as an out of cycle pay before the 1st May.

- Employee eligibility

- If a wrong employee was reported as eligible using JOBKEEPER-START-FNXX, then cancel this employee’s eligibility in next regular pay cycle by reporting the matching JOBKEEPER-FINISH-FNXX e.g. reported JOBKEEPER-START-FN01, cancel it by reporting JOBKEEPER-FINISH-FN01

- If a wrong employee was reported as ineligible using JOBKEPER-FINISH-FNXX, then cancel this by reporting the matching JOBKEEPER-START-FNXX in next regular pay cycle e.g. reported JOBKEEPER-FINISH-FN01, cancel it by reporting JOBKEEPER-START-FN01

- If an employee’s JobKeeper payment eligibility start fortnight was reported incorrectly;

- as a later fortnight, then report the correct fortnight in the next regular pay cycle e.g. reported JOBKEEPER-START-FN03 (incorrect) as start fortnight. Report JOBKEEPER-START-FN01 (correct) in the next regular pay cycle for the employee.

- as an earlier fortnight, then cancel this by reporting the matching finish fortnight, and report the correct start fortnight e.g. reported JOBKEEPER-START-FN01 (incorrect). In the next regular pay cycle report JOBKEEPER-FINISH-FN01 and also the the correct start fortnight.

- If an employee’s JobKeeper payment eligibility finish fortnight was reported incorrectly;

- as a later fortnight, then report the correct fortnight in the next regular pay cycle e.g. reported JOBKEEPER-FINISH-FN03 (incorrect) as finish fortnight. Report JOBKEEPER-FINISH-FN01 (correct) in the next regular pay cycle for the employee.

- as an earlier fortnight, then cancel this by reporting the matching start fortnight, and report the correct finish fortnight e.g. reported JOBKEEPER-FINISH-FN03 (incorrect). In the next regular pay cycle report JOBKEEPER-START-FN03 and also the the correct finish fortnight.

- Any future dated start fortnights will be ignored by the ATO. The start fortnight should not be greater than the pay date reported via STP.

- Any finish fortnights greater than the next JobKeeper reporting fortnight are ignored e.g. next JobKeeper fortnight is 07 but reported finish fortnight is 09.