This help article explains how to setup, and use the Superannuation Payments functionality within Saasu. All Australian business should now be SuperStream compliant. The Superannuation Payments report and Superstream setup in Saasu makes it easy to comply with these requirements.

How to enter Superannuation Guarantee Contribution Payments

When you enter a payroll transaction that contains an SGC (Superannuation Guarantee Contribution) superannuation amount, Saasu puts the money owed to the employee’s super company against a Liability: Employee SGC Super Payable account. We do this because the employer now owes the employee this SGC super (in the form of a liability) to the employee’s nominated super company.

At the same time, Saasu puts the same amount of money against the Expense: Employee SGC Super account. We do this because the employer has incurred an expense (despite not having paid for it yet).

Set up Superstream

After setting up Superstream you will be able to run a Superannuation Payments Report that creates payments in your chart of accounts and produces a spreadsheet file for your Super Fund/Clearing House. You can then make the payment from your online banking.

1. Add the super funds

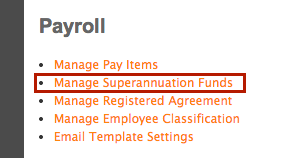

- Click the Cog icon > Settings (for this file).

- Scroll down to the Payroll sub heading and click the Manage Superannuation Funds.

- Click on Add, select the Super fund to use (contact us if it is not in the list) and enter the default payment details – This will auto-create a contact for the fund.

2. Setup super Pay Items

- Click the Cog icon > Settings (for this file).

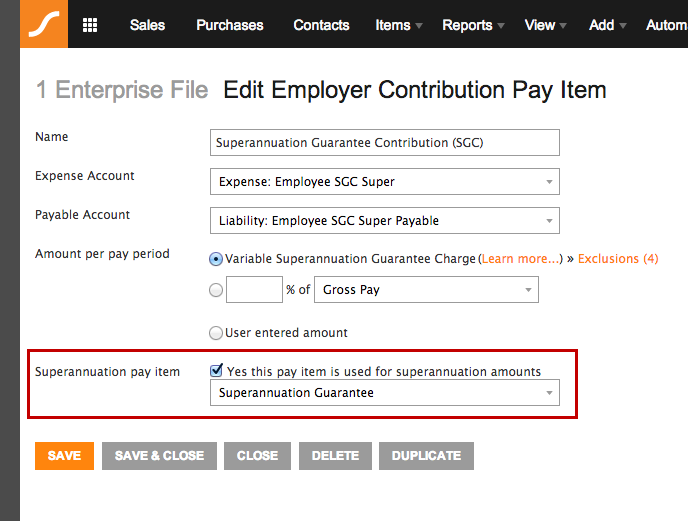

- Scroll down to the Payroll sub heading and click Manage Pay Items.

- Click on the View/Edit button next to superannuation pay items and tick the “Yes this pay item is used for superannuation amounts” box, select the payment type in the drop down box and save. This will usually be Superannuation Guarantee however could also be Salary Sacrifice. Please Note: Creating any custom Superannuation Pay Items will not be reportable through Single Touch Payroll to the ATO. We therefor recommend using the default item of “Superannuation Guarantee Contribution (SGC)”.

3. Setup Employee Details

- Click on View > Employees

- Click on the View/Edit button next to an employee (this can be done for all).

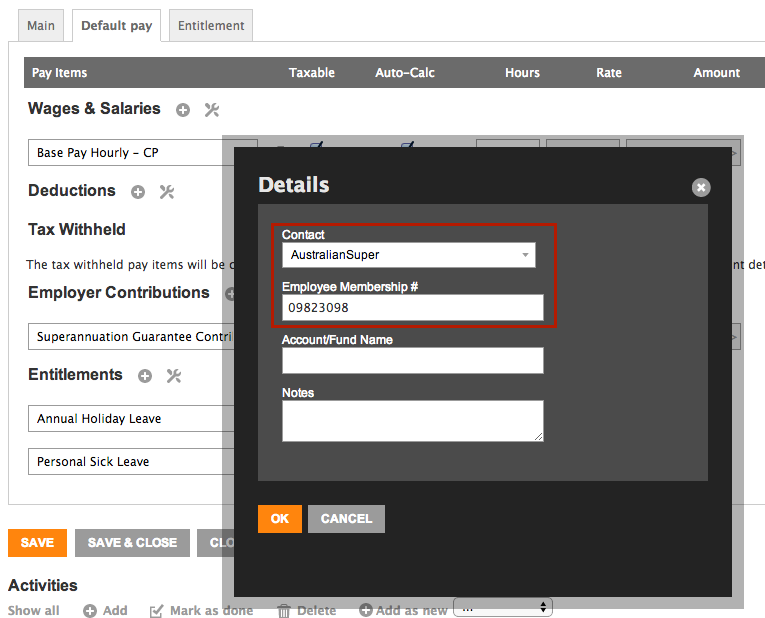

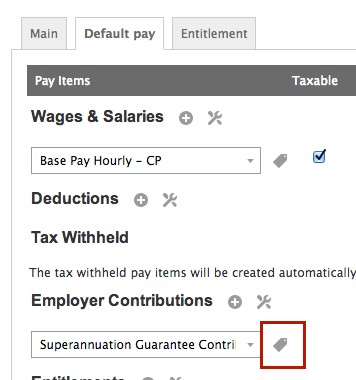

- Click on the Default pay tab.

- Use the + button next to Employer Contributions to add Superannuation Guarantee Contribution and/or Salary Sacrifice Super under Deductions. Click on the label icon next to the Pay Item and a popup screen will load.

- Fill in the data on this details page, you must enter the Contact that the system created when you added the employee’s super fund and the Membership number. If you do not enter payment details it will default to those set on the Super fund set up.

- Tick the auto-calc check box just to the right of this Pay Item if you want the Superannuation to be calculated for each pay automatically and Save.

Using the Superannuation Payments reporting tool

Each time you create Payroll transactions or process a Pay Run Saasu will pick up all the details to run the Superannuation Payments report tool.

You run the Superannuation payment tool (Superstream) from Reports > Superannuation Payments.

- Use the options to select a date range and View Report. Then tick the superannuation payments you wish to make and click next.

- Confirm payments and dates they are to be made. You also need to specify a contact person at your business – this person should be created as a contact and the bank account these payments will be made from. NOTE: Before you move on it’s important to note that by clicking “Generate purchases and payments” we will take the super fund details, the date you entered and we will create purchases for each super fund and apply a payment.

- Click Generate purchases and payments and Saasu will create purchases and apply payments. Once complete we will show you a summary of superfunds, payment method, amount and also provide a CSV you can provide to your Super fund.

SGC Calculations

The SGC percentage updates automatically in Saasu, to comply with changes in Australian legislation, as long as you use the inbuilt Pay Item.

SGC Thresholds and Limits

Currently Saasu doesn’t support threshold calculations (upper or lower) for various types of pay items that relate to pensions, superannuation, and other benefits.

If you have thresholds or limits like this, you can monitor these manually via a spreadsheet. Alternatively, you can add them in as the thresholds are met (instead of removing them later date if the thresholds aren’t met). There are several methods depending on the rules and requirements for your specific zone. We may not cover them all in the following examples.

There are several ways to handle thresholds and limits depending on your preference and procedures. Consult your accounting adviser if you aren’t sure which method is best for your particular situation.

NOTE: To reverse a pay item amount, you add the pay item but include the amount as a negative number.

Here are some candidate methods for handling thresholds and limits:

- Remove the pay item from Pays until the final pay for the threshold calculation period.

- Reverse the amount in the final pay for the threshold calculation period where the threshold isn’t met.

- Reverse the amount in the first pay of the next threshold calculation period that relates to the accrual for the previous threshold calculation period where the threshold wasn’t met.

- Add an adjusting pay by creating a pay for that employee with just that one pay item reversing the amount. Remove all the $0 or unused pay items before saving the transaction.

- Do your adjustments in bulk at the end of each quarter or year. (This may not be possible depending on the laws and regulations that pertain to the threshold or limits). You would need to do this using an adjusting pay or within a normal pay as a special pay item added in.

FAQ’s about Superannuation Payments reporting

How do I pay super contributions?

Please contact your super fund/clearing house to organise method of payment. The ATO has a good guide on Paying super contributions

Why doesn’t a super amount show on the report?

- Create super funds in your Saasu file.

- Ensure pay items are setup.

- Make sure that the employee has a super fund you just setup in step 1 chosen in default pay.

- Make sure that all payroll entries have the super fund contact selected in the label dialogue.

IMPORTANT: Did you create the payslip (either through payroll or payrun) before you completed the Superannuation Payments set up? The past payslips will not be included if these already existed before you completed the set up. They will need to have their super details manually updated on the payslip itself.