An ETP (Employment Termination Pay) can have many different lines in it depending on what has accrued and is owed. This can be a complicated area of payroll so we recommend proceeding under the advice of your accountant and the ATO.

It may include, but is not limited to:

- amounts for unused rostered days off

- amounts in lieu of notice

- a gratuity or ‘golden handshake’

- an employee’s invalidity payment (for permanent disability, other than compensation for personal injury)

- certain payments after the death of an employee.

ETPs do not include:

- a payment for unused annual leave or unused long service leave

- the tax-free part of a genuine redundancy payment or an early retirement scheme payment.

Note: The latest payslip for the employee shows the balance of accumulated entitlements.

The Payroll Officer in your business needs to identify what pay items need to be included in the last pay, based on your legal obligations/contract with the employee so they can work out which Pay Items to include in the final pay.

There are a number of inbuilt Pay Items to be used to account for Lump Sum Payments. You should use these inbuilt pay items to ensure that these are reflected correctly on Single Touch Payroll.

Steps to create a pay for Eligible Termination Payments (ETP)

With the introduction of Single Touch Payroll (STP) by the ATO as of 01/07/2018, the steps for entering an ETP as a payroll entry will depend on a number of factors.

ETP after 01/07/2018 and currently using STP reporting

If the ETP is made in the period after 01/07/2018 and you have been submitting regular pay events to the ATO via STP, then you can also submit the ETP information to the ATO via STP. Below are the suggested steps:

- calculate any entitlements owing, the amount of the ETP depending on your specific situation, and calculate any taxable elements

- create a payroll entry

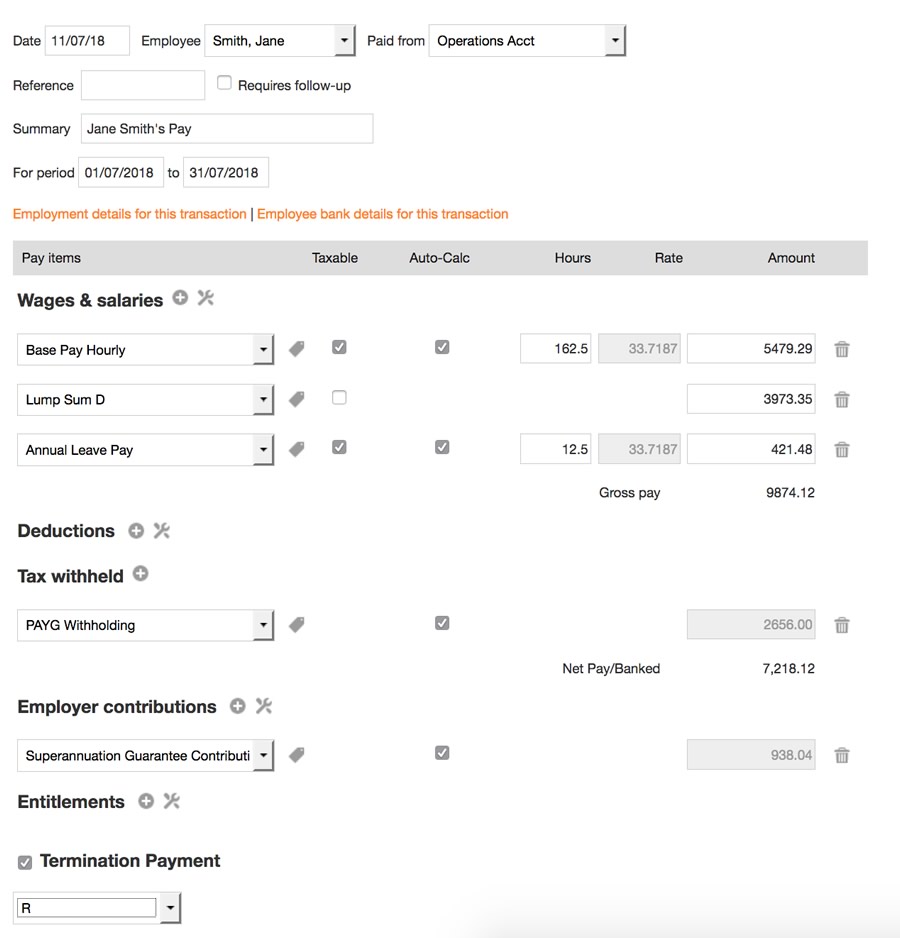

- enter the information for each element including any final pay elements, entitlements, and lump sum A, B, D, E on seperate lines under the wages and salaries heading

- enter any manually calculated tax elements (given the special nature of these final payroll entries ETP taxable elements can be different to general tax tables)

- zero out any outstanding entitlements

- click on the termination payment checkbox and select the appropriate code

- send through to ato via STP report as Regular Pay Event

- go to the employee details page, enter a termination date and remove from any payruns

- once Regular Pay Event submission has been accepted process Final FY ATO Pay Event

Note: The below example is for illustrative purposes only and your particular situation may differ.

ETP prior to 30/6/2018 or not currently using STP reporting

If the ETP was made in the period prior to 30/6/2018, or you are not yet submitting regular pay events to the ATO, then you will need to complete a manual ETP form provided by the ATO. Before completing via the PAYG Payment Summary or manual form then you can use the following steps:

- calculate any entitlements owing, the amount of the ETP depending on your specific situation, and calculate any taxable elements

- create a payroll entry

- enter the information for each element including any final pay elements, entitlements, and lump sum A, B, D, E on seperate lines under the wages and salaries heading

- enter any manually calculated tax elements (given the special nature of these final payroll entries ETP taxable elements can be different to general tax tables)

- zero out any outstanding entitlements

- go to the employee details page, enter a termination date and remove from any payruns

During the Payment Summary mapping exercise you will be able set pay items to either be included or not included in the Gross Payments value. Also you will be able to map to a Lump Sum field should there be the need.

NOTE: If you are hesitant about any of this we strongly advise that you speak with your Accountant or advisor for further advice as to what to include in the ETP entry.

FAQs

What happens if there is more than one ETP code applicable?

Where an employee receives more than one ETP payment and type, each combination of ETP payment date and code needs to be recorded via a separate payroll entry. You would then need to submit each of these payroll entries, that quote the ETP different code, separately as regular pay events before then submitting the finalisation event to the ATO.